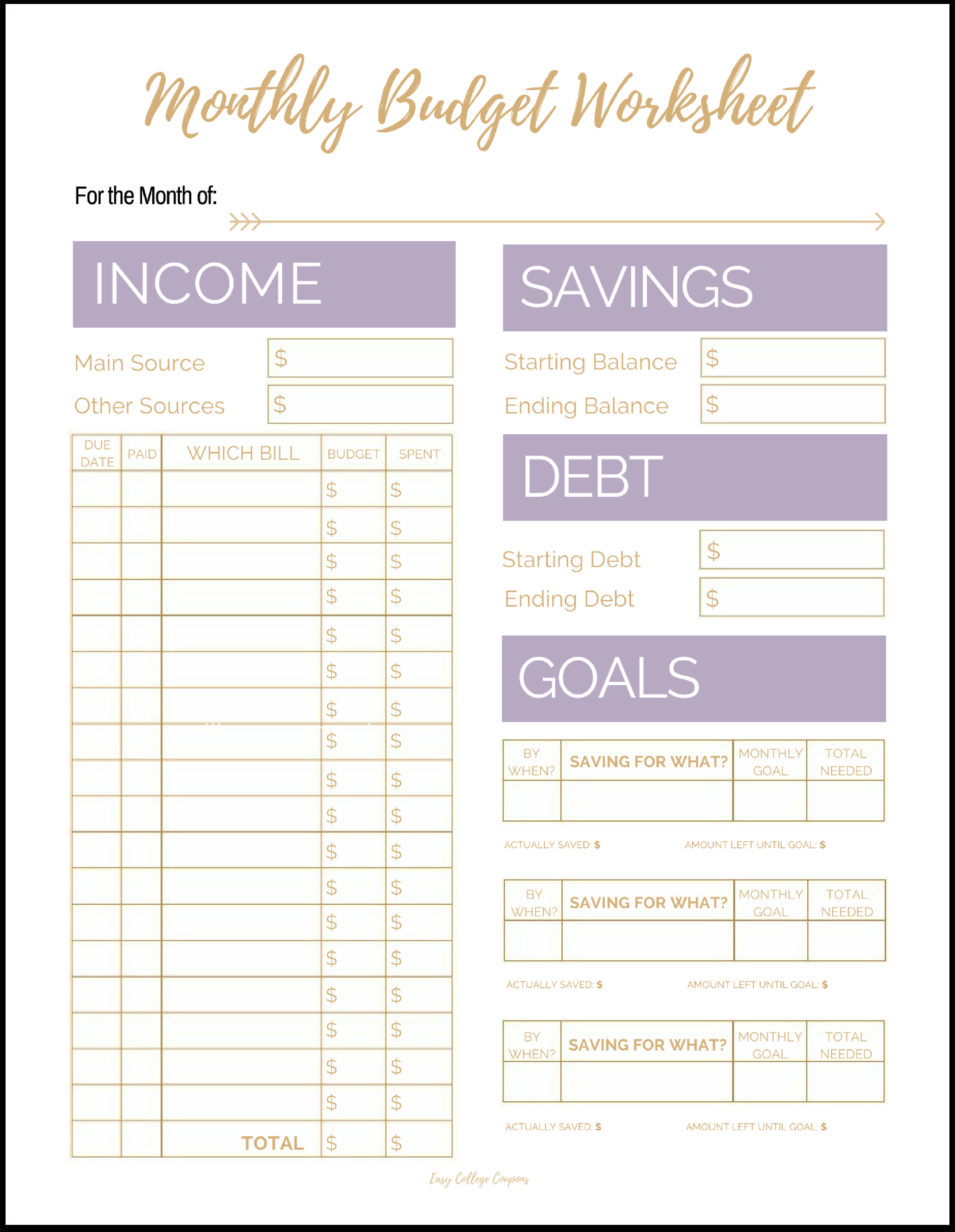

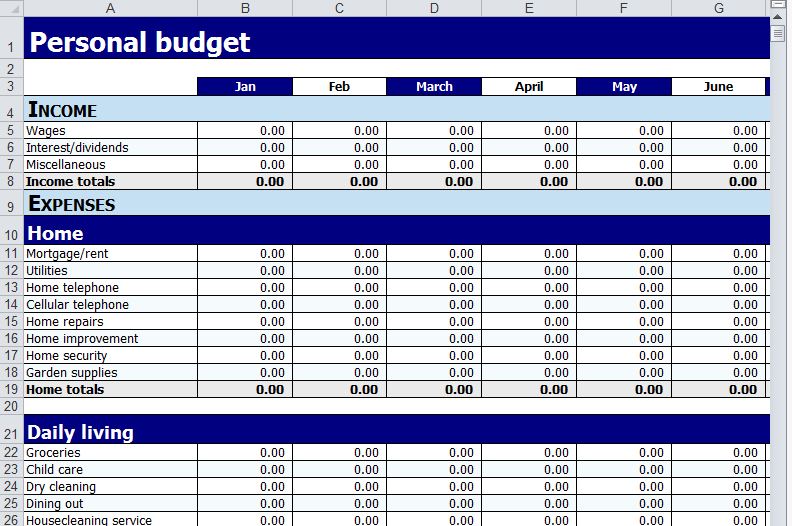

1. Identifying Goals as the Foundation for Your Budgetīudgets work best when you tie them to personally important financial goals (e.g. The five budgeting steps below will guide you through the basics of creating a spending plan to help you get what you want out of life. Monthly budgets can also work well for individuals and households with irregular income, such as small business owners and freelancers. For months with a third paycheck, use it to fund your top priority short-term and long-term goals, such as vacations, retirements, emergency savings, etc. If you are in such a situation, consider creating a monthly budget and using your first paycheck of the month to pay your bills for the second half of the month and your second paycheck to pay the bills for the first half of the next month. However, individuals and households with bi-weekly paychecks (paid every two weeks rather than twice a month) know that about twice a year they will have three paychecks in a single month. Monthly budgets tend to work best because most recurring household bills come monthly. Most budgets align to a monthly plan for simplicity’s sake, but you can create a weekly budget, a twice-a-month budget, a quarterly budget, or an annual budget. Defining a Personal and Household Budgetīudgets are simply plans for how you would prefer to spend your money. Finally, adjust your planned spending or consider additional income as necessary. Next, add your net income and subtract expenses. Next, prioritize your monthly spending, from necessary to trivial. To create a budget, first, identify important goals you want to achieve that require money. How do you put together a personal or household budget? Budgets are tools to help individuals and households get and do what is most important in their lives. Many consumers have negative reactions to the term, “budgeting” because they associate it with restrictions and deprivation. Household Budget: Essential Rules of Thumb for Planning Your Spendingīudgets, also known as spending plans, serve as tools for the individual or household to build financial stability and to make progress toward identified priorities. Make more than monthly minimum payments to credit accounts, including credit cards, mortgage, and auto loans. Prevent many of the arguments spouses have with regards to spending and finances. Understand your personal spending habits and eliminate wasteful expenditures.īe in a position to take advantage of financial opportunities, whether it’s for something on sale at the store or a chance to greatly improve your investment portfolio. Take care of financial priorities such as housing, food, and transportation, rather than disproportionate spending on entertainment and dining out.Įstablish regular investing habits in preparation for retirement.

“If You Don’t Control Your Money, It Will Control You” If You Live Within Your Budget, You Will be Much More Likely to:īuild emergency and long-term savings accounts. If you still have difficulties budgeting, remember this:

If you identify with one or more of the above myths, then make a personal decision to implement the “realities” into your thoughts. Reality: Following a budget increases the likelihood that I’ll take care of my financial priorities first, such as housing, food, savings, and transportation. Myth # 4: Following a budget inhibits my freedom of choice. Reality: The checkbook can’t help me prepare for unexpected expenses like car repairs or doctor visits.

Myth # 3: If I balance my checkbook, that’s as good as budgeting. Reality: Budgets are for anyone seeking to stabilize their finances and avoid debt. Myth # 2: Budgeting is for people who are in debt. Reality: Actually, spending less than I earn may solve many of my money problems. Myth # 1: If I had more money, all of my problems would be solved. The following are a few such myths and their corresponding realities that may help us overcome our own resistance to budgeting. Many of these reasons are based on false assumptions or myths. There are a number of reasons why many of us do not create or live by a budget. The Myths & Realities of Household Budgeting Let’s begin by looking at what a budget is and what it isn’t. If you want to build wealth and get money fit with your personal finances you must live by a budget. First, let’s take an in-depth look into why maintaining a household budget is so important to the financial success of you and your family.

0 kommentar(er)

0 kommentar(er)